What is the tax treatment of an overage clause and its subsequent gift?

Question:

We have two clients who are sisters that jointly own a parcel of land in England that they inherited from their parents in the late 1970s. The sisters are both UK resident and domiciled individuals and are over State Retirement age. Historically, the land was used for agricultural purposes, but in more recent years, they’ve simply held onto the land as an investment asset; i.e. the land hasn’t been used for any particular purpose for a significant amount of time. The only structure on the land is an old barn that is in a state of disrepair (its roof is missing, walls are damaged etc), that was formally used to store agricultural equipment.

During September 2023, my clients have signed a contract to dispose of the land to an unconnected third-party developer. The contract of sale stipulates that cash consideration of £3.5 million (£1.75 million for each sister) is payable shortly after completion. In addition, the contract contains an overage clause that stipulates the vendors are entitled to 40% (20% for each sister) of any profit attributable to the uplift in the value of the land if the developer manages to secure planning permission and disposes of the land (or parts of it) at a profit at any time within 40 years of the date of the contract.

Following the signing of the contract, the first sister has engaged the services of a solicitor and signed a Deed that transfers beneficial ownership of the right to income from the overage clause to her adult child.

What are the tax implications and reporting obligations for the sisters in respect of the disposal of land, and in respect of the gift of the right to income from the overage clause?

Answer:

Tax Implications

Capital gains tax on disposal of land

Your clients are disposing of non-residential property on an arm’s length basis. Given its historic use and state of disrepair, the barn will not amount to a ‘dwelling’ and thus no part of the land can be said to be residential in nature. As the land has been held as an investment asset for many years, the disposal, prima facie, will be a capital disposal and your client’s will be liable to Capital Gains Tax (“CGT”) at the rates of 10% or 20% on any chargeable gain they have made.

Certainly, the £3.5 million cash consideration payable after completion will be capital consideration. From that, your clients can deduct any allowable costs. As they’ve owned the land since the late 1970’s, they will need to obtain a professional valuation to rebase the value as at 31 March 1982; this will be their base cost. Of course, any incidental costs of disposal and acquisition, as well as enhancement expenses, will also be deductible in computing the chargeable gain.

Income tax on disposal of land

Hopefully, this is all sounding very familiar so far! However, there are a special set of rules that are likely to apply to the overage clause; this is commonly referred to as the ‘Transactions in UK Land’ legislation (incidentally, you may come across guidance that refers to ‘slice of the action agreements’ – please note that this is just an interchangeable phrase for ‘overage’). The relevant legislation can be found at ITA 2007, Part 9A and HMRC discuss their view of the topic at BIM60510 onwards.

The purpose of Part 9A is to bring what is arguably a profit (or share of profit) from a trade of dealing in or development of UK land, back into the charge to income tax. Where certain conditions are met, it does this by treating profits (or a proportion of profits) as trading profits.

Broadly, the conditions at ITA 2007, s 517B(4) – (7) that need to be met to trigger the legislation are as follows:

- A person realises a profit or gain from the disposal of all or part of any UK land, and

- Any

one of the conditions A to D apply, as follows:

- the main purpose, or one of the main purposes, of acquiring the land was to realise a profit or gain from disposing of the land, or

- the main purpose, or one of the main purposes, of acquiring any property deriving its value from the land was to realise a profit or gain from disposing of the land, or

- the land is held as trading stock, or

- (where the land has been developed) the main purpose or one of the main purposes of developing the land was to realise a profit or gain from disposing of the land.

Furthermore, for the purposes of the above conditions, ‘person’ includes any person (or persons) who is:

- Acquiring, holding or developing the land.

- Associated with that person, at a relevant time or

- Party to, or concerned in an arrangement.

It is therefore quite easy to see how the legislation could be triggered; particularly in respect of Condition D, i.e. on future development the sisters will be ‘persons’ who are party to an arrangement (a sales contract containing an overage clause) that causes them to realise a profit or gain on disposal of the land where the main purpose of developing it will be to realise a profit or gain.

However, presumably for the sake of fairness, ITA 2007, s 517L provides that any profit or gain attributable to a period prior to the intention to develop forming are specifically outside the scope of this legislation. We can be confident then, that the £3.5 million received will simply be treated as capital consideration, since that is what a third-party would have been willing to pay for the land on an arm’s length basis excluding any potential for development; i.e. attributable to the period of time before the intention to develop arose. HMRC appear to corroborate this view at BIM60645, BIM60650 and BIM60655.

The consideration received by the sisters in the form of the overage clause will be treated as a ‘trading profit’ and charged to income tax on them accordingly. To the extent that that element of the consideration is charged to income tax, TCGA 1992, s 37 will prevent that same consideration being charged to CGT (i.e. preventing a ‘double charge’ to tax). HMRC discuss this matter further at CG14325. It’s also worth noting at this point that there is no corresponding ‘mirror charge’ to National Insurance Contributions (“NICs”) in respect of any profit treated as a trading profit by Part 9A; hence, Classes 2 and 4 NICs are not in scope.

So, the question naturally arises, what is the value of the overage? Complicating matters in this case, is that the overage is an example of ‘unascertainable deferred consideration’. That is, consideration that is payable in the future (i.e. ‘deferred’), and where the amount of the consideration is both contingent and unknown at the date of disposal (i.e. ‘unascertainable’). Such consideration is generally treated as an intangible asset, known as a ‘chose in action’ (or in plain English, ‘a right to sue’), following the principles laid down in the case of Marren v Ingles (54TC76). This makes the overage difficult to value in practice. HMRC discuss the general principles of deferred consideration at CG14850P onward, and unascertainable deferred consideration in the context of land transactions at CG72850. Practice note 3 of the Valuation Office Agency’s ‘Capital Gains and other taxes manual’ discusses the valuation process for a ‘chose in action’. However, as this is a specialist area, we’d strongly recommend a professional valuation from an appropriately qualified person be sought in respect of the overage clause.

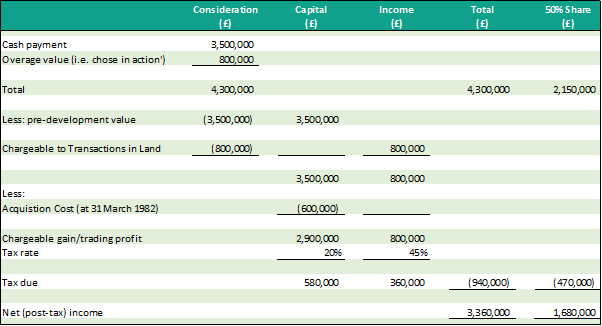

As an example, if the rebased cost as at 31 March 1982 was valued at £600,000, and the overage valued at £800,000, then each sister’s tax computation would be as follows:

Following this, one of the sisters then executed a Deed to transfer the beneficial ownership of the overage to her adult child. This is simply a gift of a capital asset (albeit an intangible capital asset), despite the value of the asset being charged to income tax under Part 9A. Importantly, the fact that it was charged to income tax does not change the nature of the asset itself; rather, it remains capital in nature. The base cost of the intangible asset will be the amount charged to income tax on initial disposal of the land.

Thus, a gift made to daughter will be treated as a disposal chargeable to CGT. As a mother and daughter are ‘connected persons’ under TCGA 1992, s 286, the proceeds received by mother on the gift will be deemed to be equal to the market value of the overage per TCGA 1992, ss 17 and 18. As this gift has taken place very shortly after the disposal of the land, the likelihood the value of the overage will not have changed and the proceeds will equal cost, hence the disposal will not create a chargeable gain nor loss.

Inheritance tax on gift of the ‘chose in action’

From an Inheritance Tax (“IHT”) perspective, the gift will be a Potentially Exempt Transfer (“PET”), meaning that mother would need to survive at least 7 years from the date of the gift for it to fully escape the scope of IHT.

Future disposal of the ‘chose in action’

If the value of the overage is later ascertained and proceeds from it are received, there will be a disposal or part-disposal of the intangible asset that takes place. The disposal will be chargeable to CGT in the tax year that the disposal or part-disposal takes place. In this case, the ordinary rules for unascertainable deferred consideration apply; i.e. any gain will be chargeable to CGT at a rate of 10% or 20%, and any loss may (where the conditions are met) by election under TCGA 1992, s 279A be carried back and treated as offset against the initial chargeable gain that arose on disposal of the land. A loss will arise if either the right extinguishes, or the proceeds paid on its disposal are less than its initial value.

An election to ‘carry back’ the loss won’t be possible for the daughter who received the overage right as a gift, as one of the requirements for an election is that the person who disposed of the original asset (i.e. the land) must also be the person disposing of the overage rights. However, it should remain possible for the sister who retains the right to the overage, assuming she is still alive and chargeable to capital gains tax at the date of its disposal/part-disposal. The effect of the election would be to reduce the individual’s capital gains tax liability on the initial disposal of land; i.e. the CGT due in respect of the £3.5 million cash consideration only. It cannot reduce the charge to income tax paid in respect of the overage right.

Reporting Requirements

CGT on UK property return

A 60-day CGT on UK Property return will not be required, as the land is non-residential in nature, and the vendors are both UK resident individuals.

Post transaction valuation check

Given the potentially contentious nature of the ‘chose in action’ valuation, one may be tempted to request a Post Transaction Valuation Check from the HMRC Shares and Assets Valuations (SAV) team, by submitting a completed Form CG34 with the appropriate attachments. However, given the receipt of the ‘chose in action’ creates a charge to income tax rather than capital gains tax, it is unlikely that HMRC would accept such as request, as they state at CG16600:

“A request for a post transaction valuation check can be made at any time after the transaction has taken place but before the Return is filed for the period in which that valuation is to be used in the computation of a capital gains liability [emphasis added].”

Self-assessment tax return

As the sisters are receiving consideration treated as a trading receipt, the untaxed income is likely to cause them to meet the Self-Assessment criteria. This will be the case if the value received in respect of the overage is more than £1,000 (as to exceed the Trading Allowance). Therefore, as the disposal took place during the 2023/24 tax year, they’ll need to register for Self-Assessment and notify HMRC of their chargeability to tax by 5 October 2024 (if they haven’t already done so) and file a tax return by 31 January 2025 (where filing electronically). The Self-Assessment criteria are outlined by HMRC at SAM100060 onwards, and it’s possible to check the filing requirement using the online Self-Assessment Tool.

The element of the disposal chargeable to CGT (the cash consideration, plus any allowable costs) should be reported in Boxes 14 to 22 on Page CG 1 of the ‘Capital gains summary’ (SA108) form.

Neither HMRC Manuals, the SA100 or supplementary page notes, nor the legislation specify how, from a practical perspective, receipts subject to the ‘Transactions in Land’ legislation should be reported on an individual’s tax return. As the legislation treats the receipt as a trading receipt, such amounts should presumably be reported on either the ‘Self-employment (short)’ (SA103(S)) or ‘Self-employment (full)’ (SA103F) form. This does pose practical problems, as the forms require details such as:

- Business name

- Description of business

- Business address

- Accounting period start and end dates

which do not align well with the reality of the situation; e.g. accounting start and end dates do not, as a matter of fact, exist. Furthermore, as this would generate a charge to Class 2 and possibly Class 4 NICs (although the latter can be mitigated with relevant entries onto the Self-employment pages), it’s difficult to envisage how reporting via the SA103 would work in practice.

Therefore, as a practical ‘workaround’, it may be more appropriate to enter the details into Boxes 17 to 21 of Page TR 3 on the ‘Tax Return’ (SA100). These boxes are usually reserved for sources of income charged to tax under the ‘Miscellaneous Income’ legislation. However, as the Transactions in Land legislation does not create a charge to NICs, the effect from an income tax perspective should be equivalent to if the overage consideration is reported on the SA103(S) or SA103F. Of course, if reporting the overage on the SA100, it would be prudent to disclose full details of the transaction in the ‘white space’; i.e. Box 19, Page TR 7, on the SA100, or as a separate attachment to the return.

Ryan Ward-Cabello

Tax Consultant

Related News Articles

Mileage Tax Relief Guide

Guide to Claiming Tax Relief on Mileage Expenses (Where Reimbursed Below HMRC Rates) Step 1: Confirm Eligibility You may claim tax relief if: - The mileage relates strictly to business travel (not ordinary commuting). - You are using your own vehicle. - Your employer reimburses you below the HMRC Approved Mileage Allowance Payments (AMAP): -…

Government to Raise Income Threshold for Self-Assessment Reporting and Launch Simple Online Tax Payment System

Move expected to reduce administrative burdens for up to 300,000 taxpayers The Government has announced its intention to raise the income threshold at which individuals are required to register for Self-Assessment. This change will affect taxpayers with low levels of trading, property, or miscellaneous income and forms part of a broader package aimed at simplifying…

Mandatory Real-Time Reporting of Benefits in Kind Delayed Until April 2027

HMRC delays mandatory payrolling of most employee benefits by one year HM Revenue & Customs (HMRC) has confirmed a 12-month delay in the implementation of mandatory real-time reporting for most benefits in kind (BiKs). Initially expected to come into force in April 2026, the requirement will now apply from April 2027. This extension follows feedback…